May the Market Be Ever In Their Favor: Seventh Grade Accepts the Portfolio Management Baton (for the 10th time)!

It was once again time to kick off Speyer’s Financial Literacy Program, with members of the Eighth Grade officially “handing off” the responsibility for management of Speyer’s Financial Literacy Fund Portfolio to a very eager Seventh Grade. This was the 10th hand-off and watching the events of the morning, one could say the seventh graders are very invested in this aspect of their curriculum – okay, that's a joke we make every year…why stop now?!

The centerpiece of the Seventh Grade financial literacy curriculum is that they assume the role of managers of a real investment portfolio, which was a gift from the Harada/Peterson family. Here's how it works: each incoming grade has a gift of $20,000 and over their nine years at Speyer, this portion will grow with investment returns. At the time of their Eighth Grade graduation, the original $20,000 rolls forward to the incoming Kindergarten class, and the increase in total value from inception is quantified. This value is then split into two: first half is allocated by the eighth graders as a graduation gift back to Speyer, and the second half is gifted pro rata to the students themselves to further their education.

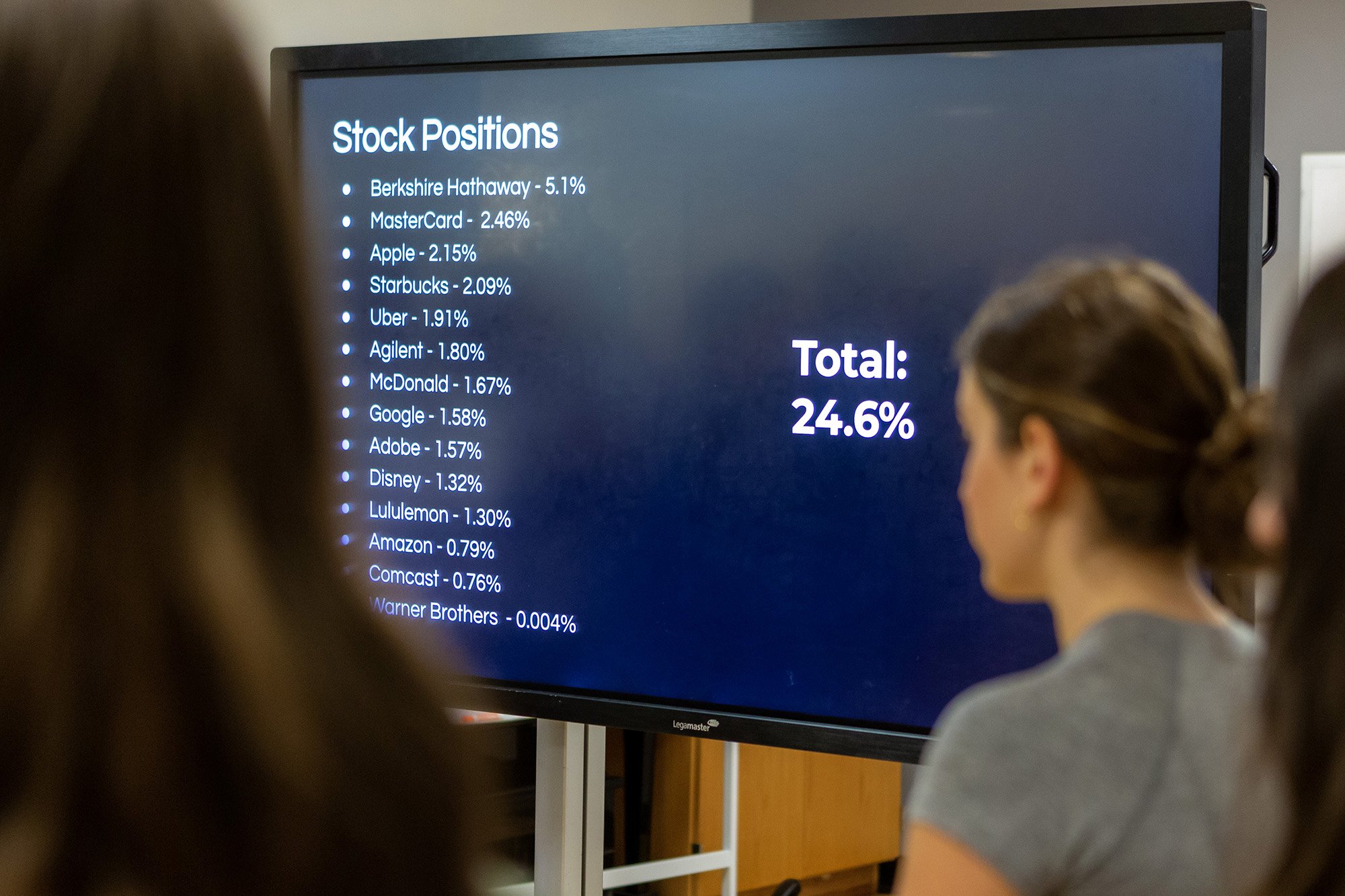

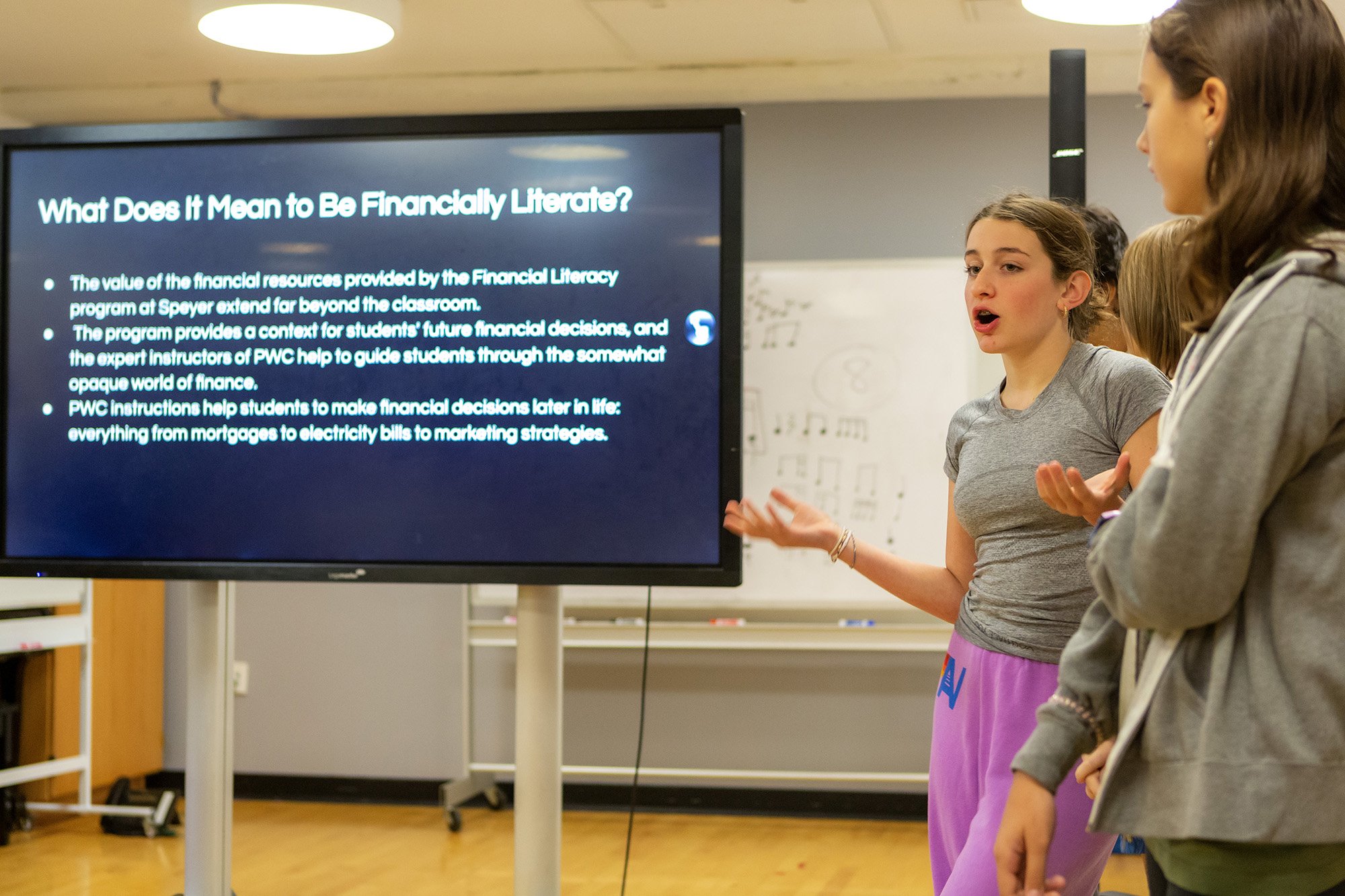

During their explanation of what the seventh grade will tackle throughout the school year as the fund portfolio managers, the eighth graders (with leadership and guidance from Speyer’s CFOO Scott Molin) shared what it was like managing the portfolio last year and how they dealt with volatility of the market, as well as described what sales and investments they made, why they made them. what stocks are currently in the portfolio.

After hearing from their fellow students, the seventh graders welcomed Lauren Matles and Michael Katz from Wells Fargo Advisors, who presented information about the history of the stock market and trends and observations of the stock market patterns over time. They also explained some "stock market basics" such as the definitions of stocks, bonds, mutual funds, exchange traded funds, diversification, trading costs, hyper-inflation, and oligopolies. One of the main themes of Speyer’s literacy fund is how to invest in a socially responsible way and the students heard about how they, as the new portfolio managers, will decide impactful and meaningful ways to invest.

And then…insert drum roll…it was time for the always-exciting stock picking simulation game! Seventh graders were split into small groups and had four rounds to choose how to allocate their investment among a group of five imaginary stocks (as well as an index fund and a value fund), with each team aiming to have the highest percent return from their picks at the end of the game.

When the results were announced after each round, Speyer's Dance Room could have been mistaken as a boisterous trading floor, with high-fives and cheers, groans and gasps as teams saw their investment strategy didn’t work as well as they had hoped.

Being a portfolio manager is just one way our Middle School students stretch their leadership muscles. All of us wish the seventh graders well with this new responsibility as they begin to manage the Financial Literacy Fund Portfolio (which is currently around $260,000) – and, as we say every year, may the market be ever in their favor!

Special thanks to Speyer’s CFOO Scott Molin, Head of Middle School Dorothy Meyer, Lauren Matles and Michael Katz from Wells Fargo Advisors, and the Harada/Peterson family for supporting and helping our Middle Schoolers with this fantastic and unique part of our curriculum!

And thanks to Ethan David Kent for the awesome photos of the morning!